Services

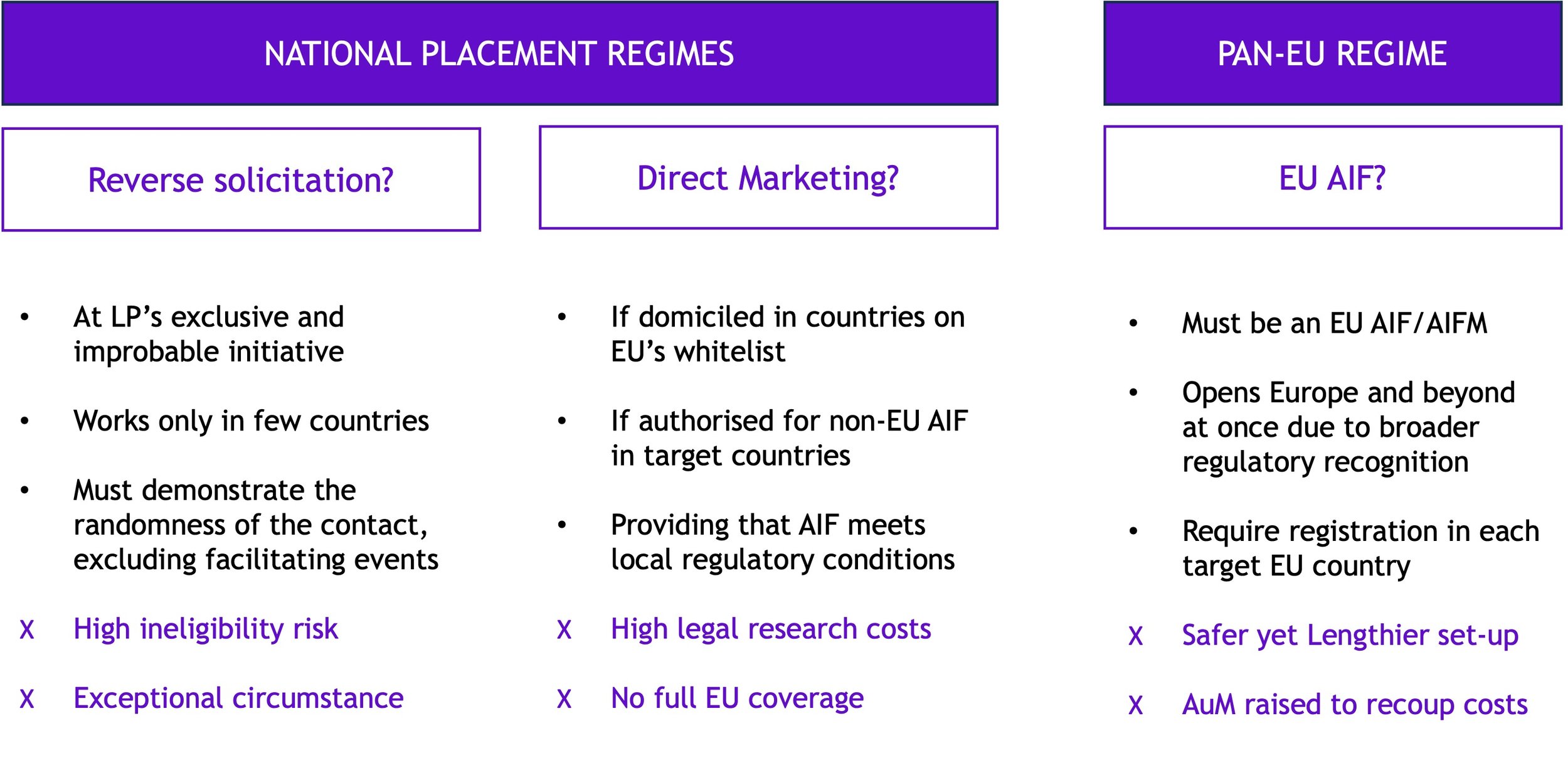

Raising and engaging LPs in Europe relies on 3 routes that are being either shut down (reverse solicitation), divergent (national placement regimes) or costly to implement (full-scope EU AIF)

By consolidating relevant experts and technologies under-one roof, Dorhyan.eu makes compliant EU access affordable, especially for its two key client-groups:

Emerging fund managers looking to be EU and institutional compliant

Established Non-EU institutional AIF looking to engage and raise from European and global LPs without regulatory risks

Its three services are as follows:

NPRR as a service

Delivering exceptional value from €699 pcm

Based on your master’s fund country of domicile and your GP’s regulatory situation, we will take care of the whole bureaucracy to ensure you are registered with relevant target jurisdiction. Then pick your placement agent from our curated network to expand your LP coverage (* additional fees apply) .

Our tech platform makes it simple fo ryou to file documents, monitor marketing and get introduced to the relevant LPs in the right format.

EU AIF as a Service

Parallel fund, feeder or club-deal

Benefit from our turnkey GP/LP structure to create the relevant EuUstructure you need to raise and deploy fund within the EU fund. Be it in the form of a club-deal (co-investments), notes, feeder or parallel-fund, we will have it set-up and ready for you in less than 8 weeks thanks to our turnkey Luxembourg structure.

Your fund will be automatically listed on in-house marketplace reserved to 650+ accredited LPs, our network of marketing agents and cap-intro platforms

Our technology means it is all unified under one transaction flows so that it adds no new process on your side. We are here to make it all happen smoothly

Dedicated AIF as a Service

Your own version, just for you from €150k all in.

Your own and exclusive AIF and European GP/LP structure under your appointed AIFM among our preferred partners, in less than 10 weeks thanks our turnkey EU structures.

You will pick your preferred AIFM and fund administration set-up.

Your fund will be automatically listed on in-house marketplace reserved to 636 accredited LPs, our network of marketing agents and platforms

Our technology means it is all unified under one transaction flows so that it adds no new process on your side. We are here to make it all happen smoothly